What is an Independent Contractor?

A business determines whether an individual qualifies as an independent contractor or an employee by adhering to guidelines established by the IRS. Generally, if a business has the ability to direct only the desired outcomes of your work, rather than the methods used to achieve those outcomes, you may be classified as an independent contractor.

As an independent contractor, the IRS recognizes you as self-employed, meaning you are not an employee of any company. You have the option to operate as a sole proprietor, a limited liability company (LLC), or an S-corporation. Given that the majority of businesses in the U.S. operate as sole proprietorships, this article will focus on that particular business structure.

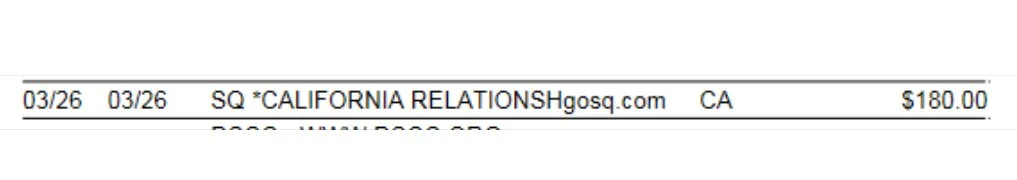

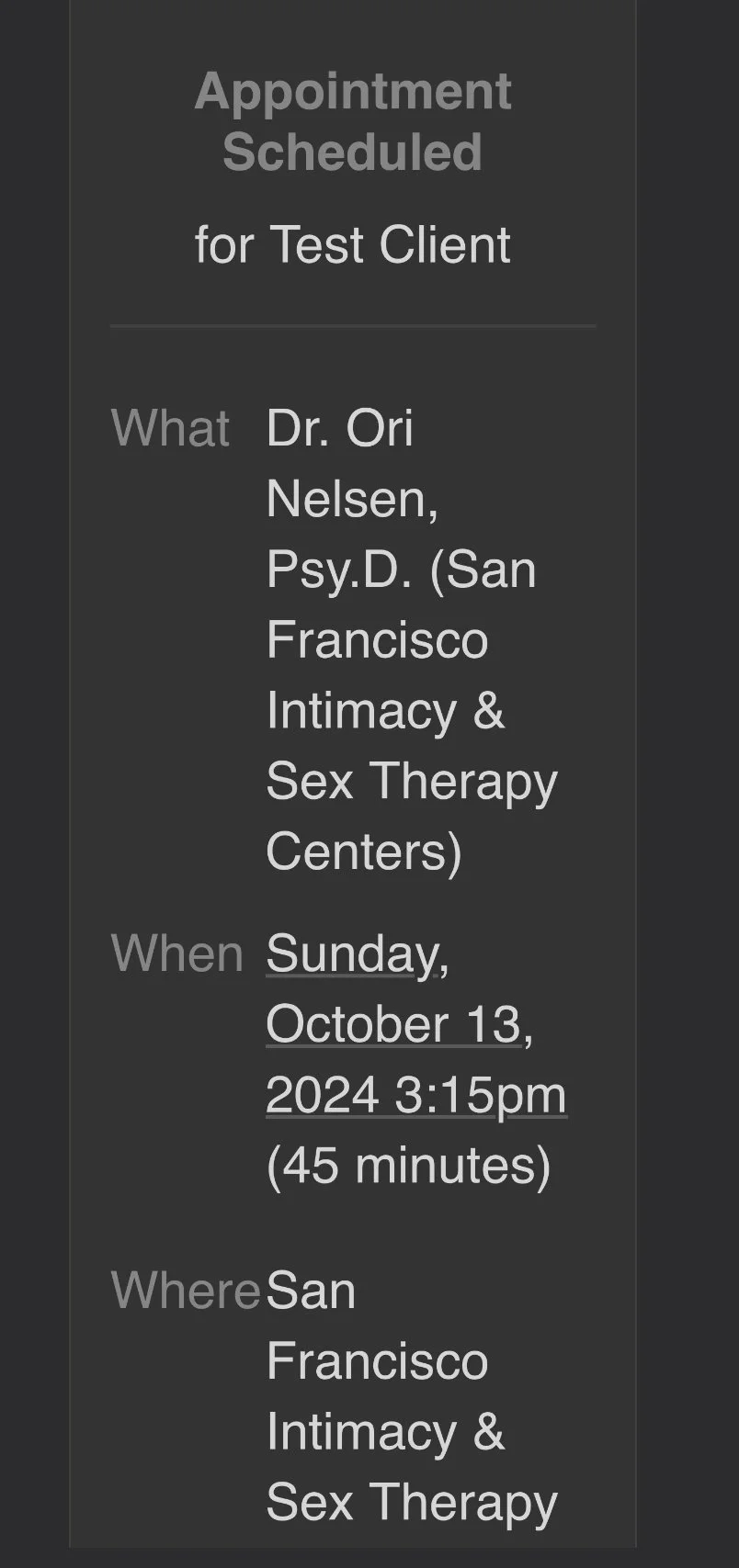

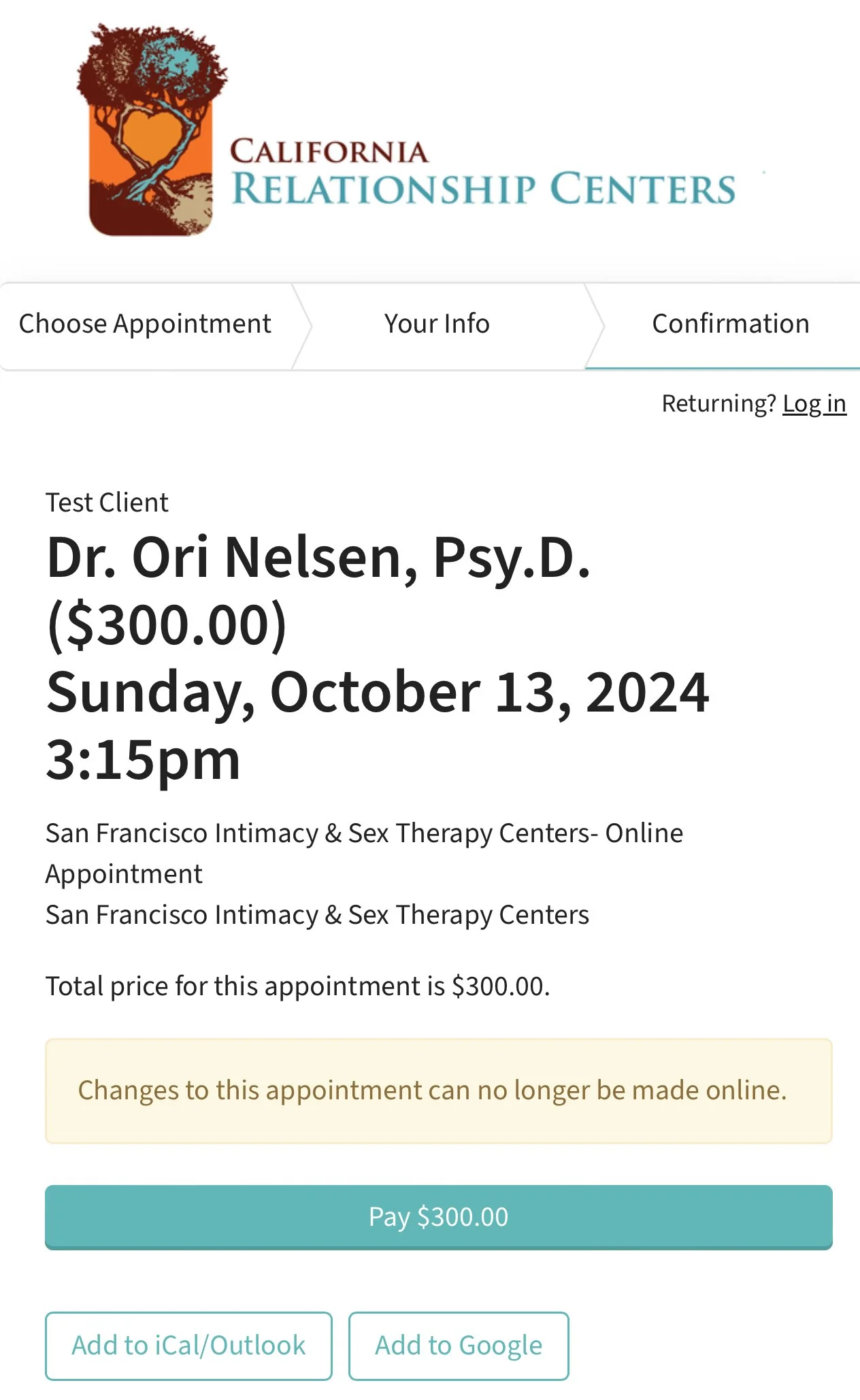

CA Relationship Centers / San Francisco Intimacy & Sex Therapy Center is a marketing and referral service for therapists, sexologists and coaches who want community while in private practice. We connect clients with independent therapists who partner with us, and we provide tools such as customized marketing, scheduling tools, billing route, to cultivate the most efficient process.

We do not directly provide therapy and coaching, but rather, support our community of expert therapists and coaches in building their private practices while supporting clients in receiving the best attachment-based intimacy and sexuality counseling.

As an Independent Contractor, you are responsible for providing the space to host sessions, whether that is a physical location or online, business phone, email and other necessary aspects of managing your business and private practice. You manage your own schedule, decide when to accept more referrals with us and select which modalities and interventions you use with any given client. As an independent contractor you are responsible for having your own malpractice insurance. You are responsible for your taxes as well.

How does an independent contractor handle tax obligations?

Contractors are required to file extra forms and submit estimated taxes on a regular basis. There are four primary distinctions between filing taxes as an employee and as an independent contractor, which include:

1. Reporting self-employment income and deductions on Schedule C.

2. Paying self-employment tax using Schedule SE.

3. Making quarterly estimated tax payments.

4. Receiving Form 1099-MISC instead of a W-2.

Reporting Self-Employment Income

The process for reporting income earned as an independent contractor differs from that of an employee. As an independent contractor, you are required to file Schedule C in conjunction with your personal tax return. Schedule C outlines your business's profit and loss.

It is important to note that independent contractors are classified as self-employed individuals, essentially operating their own one-person business. Therefore, all income earned as an independent contractor must be reported on Schedule C, and you will be responsible for paying income taxes on the total profit.

Deductions

As a business owner, you are eligible to take advantage of various business deductions that can significantly lower your taxable income. These deductions are reported on Schedule C, along with your income.

Independent contractors may qualify for several deductions, including those for health insurance, home office expenses, mileage, and phone bills.

Additionally, the Tax Cuts and Jobs Act introduced the qualified business income deduction, which may permit certain independent contractors to deduct up to 20% of their business income.

You will report self-employment taxes by filing Schedule SE with your personal tax return. These taxes are in addition to any income tax obligations you may have.

Quarterly Estimated Tax Payments

The U.S. tax system operates on a pay-as-you-go basis, which requires regular tax payments throughout the year.

As an independent contractor, however, you are responsible for making regular tax payments throughout the year. This is done through quarterly estimated income tax payments. You can determine your quarterly obligations by estimating your total annual income or by using the amounts you reported as estimated taxes in the previous year.

While you will not know the exact amount of tax owed until you file your personal tax return at year-end, it is crucial to spend time making accurate estimates. Underpayment of estimated taxes may result in penalties.

Additionally, please remember to fulfill your estimated tax obligations to your state. In addition to federal estimated income tax payments, state tax payments are also required throughout the year.

As an employee, you receive a W-2 form annually, which provides a summary of your earnings and the amount withheld for taxes from your paycheck. In contrast, independent contractors receive a 1099-MISC form instead of a W-2. This form outlines the total payments received throughout the year, allowing you to verify that you are accurately reporting all income earned.

If you earned less than $600 from a particular client during the year, you will not receive a 1099-MISC. However, it remains essential to report that income on your Schedule C. Therefore, maintaining an organized accounting system is crucial.

Independent Contractor Tax Deadlines

As an independent contractor, it is important to be aware of additional tax deadlines beyond your personal income tax obligations. Alongside the personal income tax deadline of April 15, you will also be responsible for federal and state quarterly tax payments.

Quarterly Estimated Tax Filing

You are required to make estimated tax payments four times a year. To determine the amounts owed at each deadline, you may utilize Schedule SE. The deadlines for these quarterly estimated tax payments are as follows:

- April 15: for income earned from January through March

- June 15: for income earned in April and May

- September 15: for income earned from June through August

- January 15: for income earned from September through December of the prior year

Please note that if your state imposes income taxes, you will also need to make estimated tax payments at the state level. It is advisable to consult your state’s business resources for specific deadlines and any required forms.

Personal Income Tax Deadline

The personal income tax deadline for independent contractors is identical to that of employees. All personal income taxes, filed using Form 1040, are due on April 15 each year. In instances where April 15 falls on a weekend or holiday, the due date will be the next business day.

Along with Form 1040, you will need to submit Schedule C, Profit and Loss from Business, and Schedule SE, Self Employment Tax.

If you are unable to file your taxes by the April 15 deadline, it is recommended to submit Form 4868 to request an automatic six-month extension. Please be aware that this extension pertains only to the filing of your paperwork; any taxes owed must be paid by the April 15 deadline to avoid potential penalties.

State Tax Deadline

If your state imposes income tax, you will also be required to file and pay state income taxes. It is essential to check with your state to understand the timing and procedure for paying state taxes as an independent contractor.

What is a Sole Proprietor?

A sole proprietorship refers to a business operated by a single individual who has not registered as a formal business entity, such as a corporation or limited liability company (LLC), with the state or the Internal Revenue Service (IRS). If you generate income through your business activities, you are classified as a sole proprietor.

A sole proprietor may work as an independent contractor and receive a 1099 tax form from clients at the end of the fiscal year, resulting in a dual classification as both a sole proprietor and an independent contractor.

For tax purposes, the IRS considers business income earned by a sole proprietor to be personal income. Additionally, the sole proprietor is personally liable for any debts incurred by the business.

What is an Independent Contractor?

An independent contractor is an individual who provides services to one or more companies on a contractual basis. While the hiring entity can specify the outcomes desired, they typically do not dictate the methods or timing of completion. Professions such as IT consultants, graphic designers, and web designers often operate as independent contractors.

If an independent contractor has not established a separate business entity, they will file a Schedule C, similar to sole proprietors.

Companies engaging independent contractors are not required to withhold income tax, Social Security, or Medicare contributions. Consequently, independent contractors generally need to make estimated tax payments throughout the year to account for income tax and self-employment tax obligations.

Determining Whether to Operate as a Sole Proprietor or an Independent Contractor

It is important to note that individuals do not need to limit themselves to one designation. Many self-employed individuals function as both sole proprietors and independent contractors, depending on the nature of their work.

For instance, a musician may generate income through various avenues such as live performances, teaching music lessons, and selling merchandise. If the musician has not established a formal business entity, they are classified as a sole proprietor, as they are earning business income.

Similarly, if the musician agrees to create original music for a corporate video for a fee, they are also generating income in the capacity of an independent contractor.

Both sole proprietors and independent contractors are required to:

- Complete Schedule C when filing their taxes.

- Pay self-employment taxes, which encompass the Medicare and Social Security taxes typically withheld by an employer.

- Make estimated income tax payments to the IRS and their state tax authority if they expect to owe $1,000 or more in taxes when filing their return.